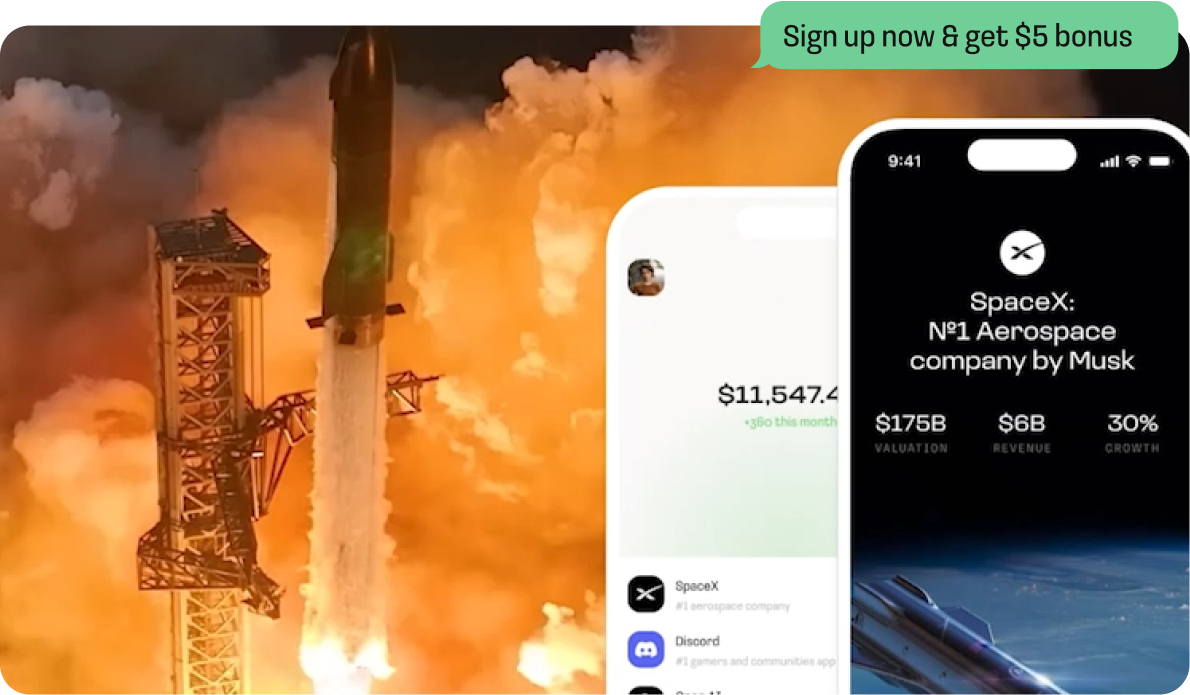

Melabur dalam pra-IPO: buat duit dengan menyokong gergasi teknologi swasta Amerika Syarikat.

Untuk semua sekarang • Dari $10 • Aplikasi mudah alih

Syarikat swasta membesar 8 kali lebih pantas daripada saham awam

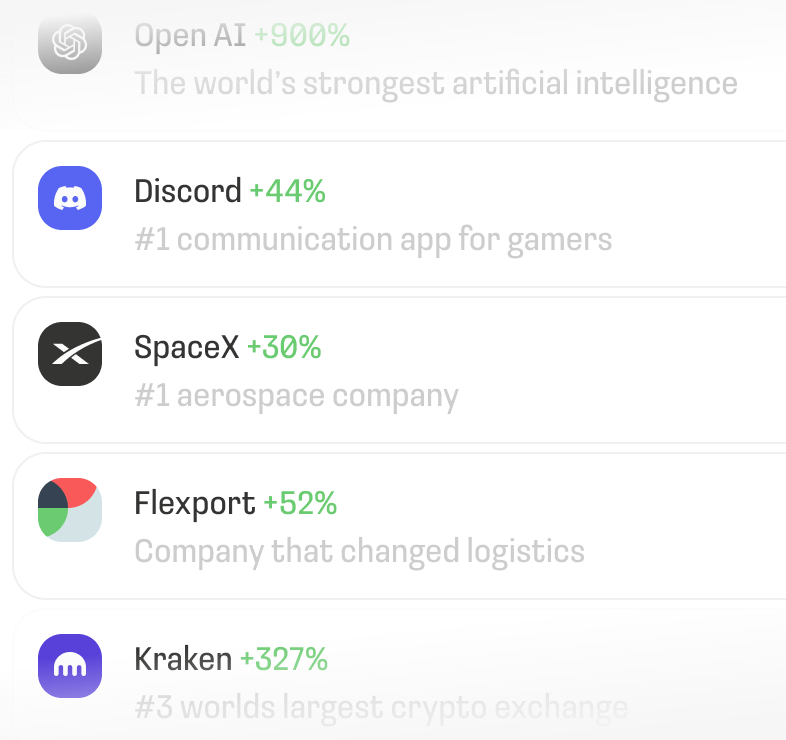

Melabur dalam syarikat besar yang terkenal yang mengubah pasaran dengan membangunkan teknologi baru, dan cenderung untuk berkembang lebih pantas daripada instrumen pelaburan tradisional

Sebelum ini hanya untuk pelabur berakreditasi, kini tersedia untuk semua

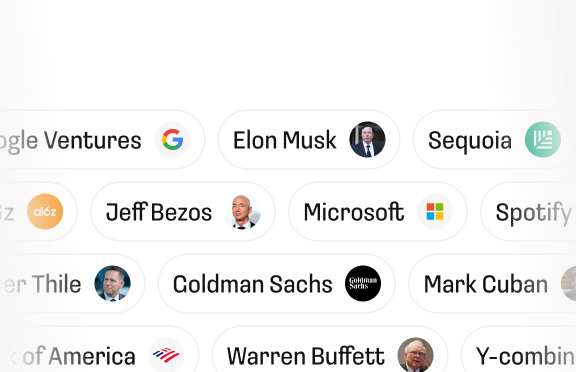

Melabur dengan cara yang sama seperti ahli kapitalis teroka: Warren Buffett, Goldman Sachs, Elon Musk, Jeff Bezos, Peter Thiel, dan lain-lain

Bermula dari $10

Sebelum ini, pelaburan seperti ini bermula dari $100K. Zorion telah menjadikannya boleh diakses oleh sesiapa sahaja

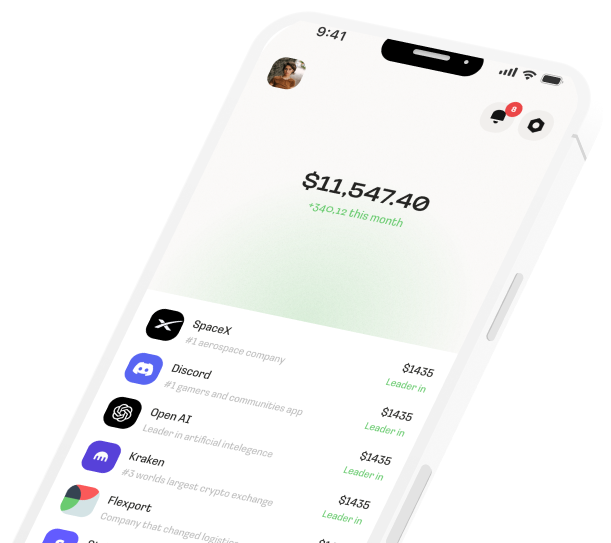

Bina dan urus portfolio pra-IPO semasa dalam perjalanan dengan Aplikasi Zorion®

Pilih salah satu daripada syarikat pra-pilihan kami

Baca maklumat terperinci tentang syarikat dengan data sejarah, ramalan, dan deskripsi teknologi

Melabur dari $10

Tandatangani semua dokumen dalam aplikasi

Zorion adalah broker peniaga berlesen di rantau APAC dan mengikut piawaian industri terbaik

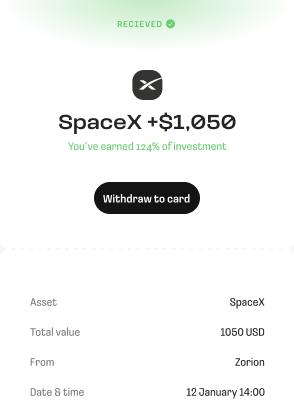

Licence nr. SL/23/0025Dapatkan pulangan anda apabila syarikat menjadi awam

Kami memilih dengan teliti syarikat besar dan stabil yang kemungkinan akan menjadi syarikat awam dalam masa terdekat

Mulakan perjalanan anda sekarang

Mulakan pelaburan anda sekarang sebelum yang lain

Ketahui lebih lanjut tentang kami

Zorion adalah syarikat berlesen di bawah Lembaga Perkhidmatan Kewangan Labuan untuk menyediakan perkhidmatan kewangan sebagai Pemegang Lesen Sekuriti.

Lesen ini membolehkan Zorion bertindak sebagai peniaga broker dan mengatur penjualan dan pembelian sekuriti, termasuk sekuriti yang tidak disenaraikan di pasaran saham.

Anda boleh memikirkan Zorion sebagai pasaran sekuriti, di mana bakal pelabur (anda) dan peluang pelaburan yang menarik dan kami menyediakan infrastruktur dan sokongan perjanjian yang diperlukan.

Zorion memberi anda peluang unik untuk melabur dalam syarikat yang mempunyai potensi pertumbuhan tinggi yang belum melanda bursa saham.

Sebelum ini, ini adalah taman permainan hanya untuk pelabur besar dengan poket dalam bermula dari $ 1000.

Tetapi di Zorion, kami menjadikan arena ini boleh diakses oleh semua orang. Kami memilih syarikat dari pasaran dengan potensi pertumbuhan yang tinggi hanya untuk anda

Zorion memberi anda peluang eksklusif untuk melabur dalam syarikat yang belum memasuki bursa saham.

Sebelum ini, ini adalah taman permainan hanya untuk pelabur besar dengan poket dalam bermula dari $ 1000.

Tetapi di Zorion, kami menjadikan arena ini boleh diakses oleh semua orang. Kami memilih syarikat dari pasaran dengan potensi pertumbuhan yang tinggi hanya untuk anda.

Amaun pelaburan minimum ialah $10. Bergantung kepada keperluan pelaburan, beberapa tawaran mungkin memerlukan jumlah permulaan yang lebih tinggi. Anda boleh dapatkan tawaran langsung terkini di Zorion App.

Jika anda belum memuat turun Aplikasi Zorion, anda boleh memuat turunnya di Appstore atau Play Store

Aplikasi kami menjaga kertas kerja secara automatik! Setelah anda membuat pembayaran, Perjanjian Pelaburan yang mengikat secara sah yang mengesahkan pemilikan anda akan dihantar terus ke e-mel anda dan juga boleh diakses dalam aplikasi.

Dokumen-dokumen ini adalah jaminan undang-undang anda terhadap kepentingan anda, memastikan ketelusan dan keselamatan penuh.

Setelah membuat pelaburan seterusnya ke atas aset yang sudah anda miliki, anda akan menerima penyata Akaun Pelaburan yang dikemas kini yang mencerminkan semua pelaburan anda pada aset tertentu.

Bayaran balik adalah percuma dan tersedia untuk 10 hari pertama pelaburan.

Selepas 10 hari berlalu, anda mempunyai peluang untuk meminta pembelian balik. Syarat-syarat dan penerimaan pembelian balik di bawah budi bicara Zorion dan mungkin bergantung kepada keadaan pasaran semasa.

Muat turun aplikasi sekarang dan terima bonus selamat datang percuma $5